A deposit is a transaction that engages people in monetary obligations to transfer funds for payment, installment, safekeeping, and other personal purposes. Commonly, banks are one of the main entities that receive deposits. Respective stakeholders usually expect gradual interest in return. You may also see invoice samples.

There are still a lot of deposit transactions in other areas of concern. Either way, it is always important to secure a deposit invoice. Writing an invoice – a deposit invoice for this matter monitors the every designated amount set for deposit. A proforma invoice could come in handy for other alterable deposit transactions.

caanet.org

File Format

invoicepayment.ca

File Format

wikileaks.org

File Format

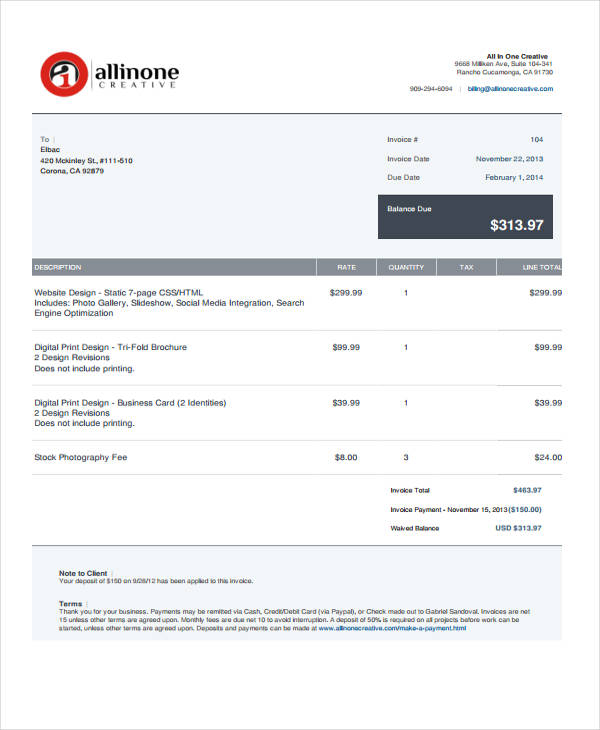

bookkeeping.godaddy.com

File Format

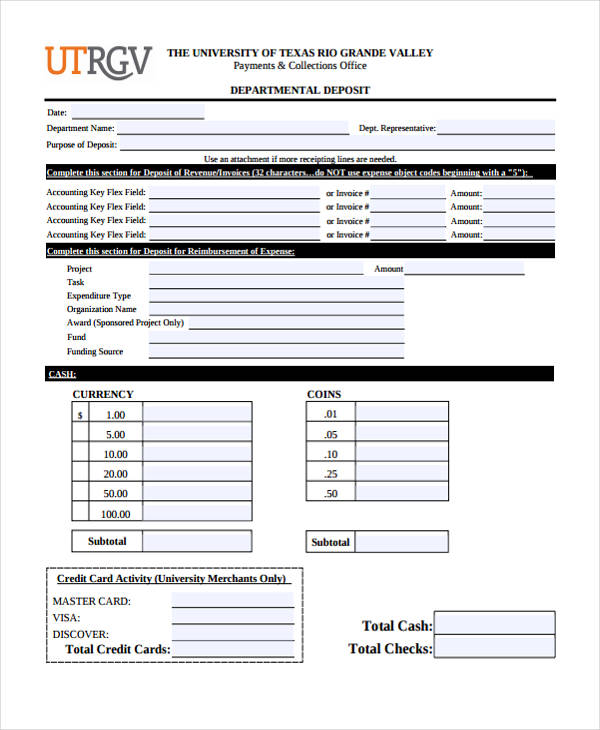

utrgv.edu

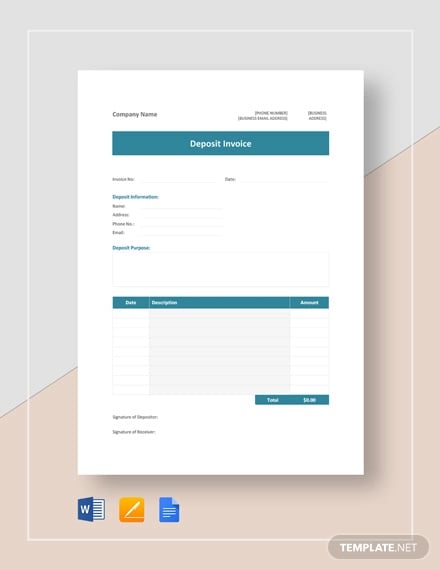

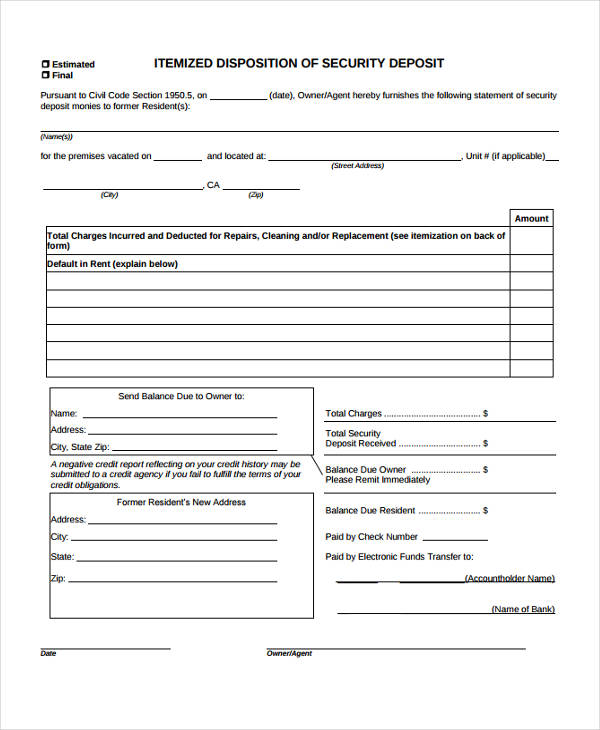

File FormatA deposit invoice is a specific type of invoice that compiles all the day-to-day deposit. It sees to it that all transactions are covered and taken note of. This type of invoice monitors the accuracy of the input of data with the actual numbers involved in daily deposit transactions.

Service invoice templates and lease invoice templates could also be filled out with information from deposit invoices since both come into similar compensation conditions in terms of deposit payment for services and lease respectively.

Impulse creation of a deposit invoice for any personal business of yours could be a total mess if you aren’t that familiar of its basic inclusions.

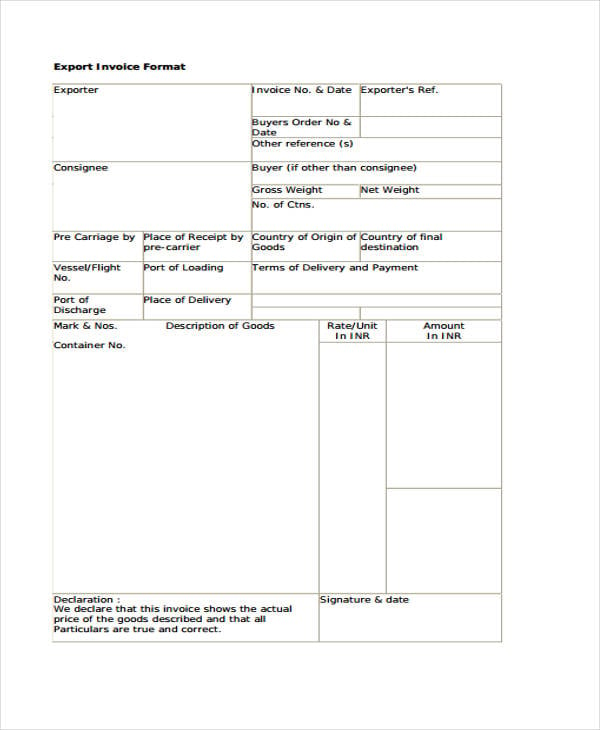

ifco.in

File Format

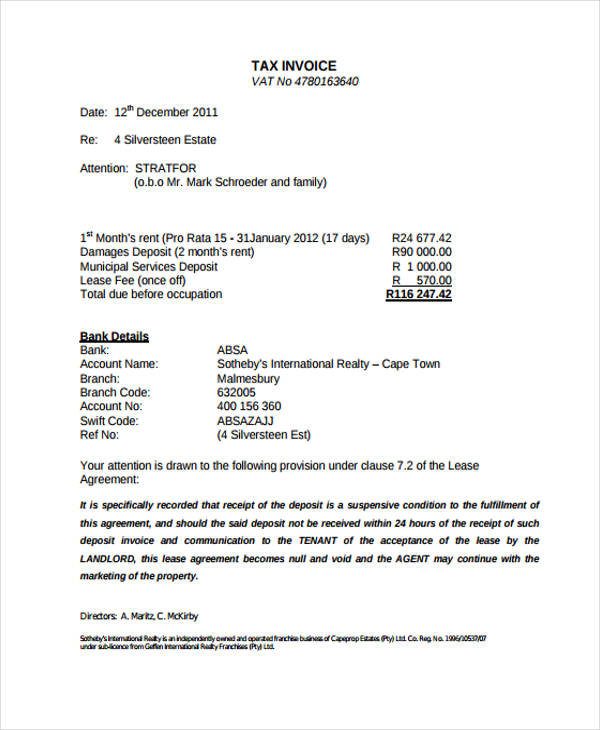

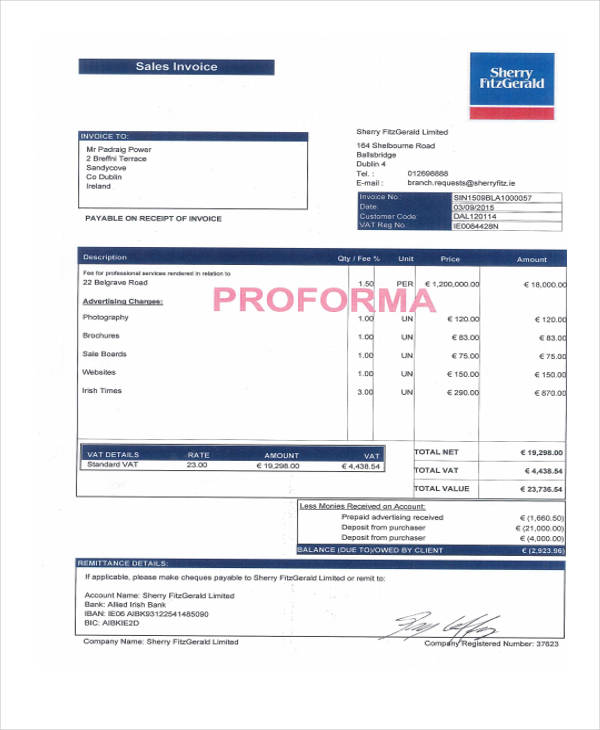

sherryfitz.ie

File Format

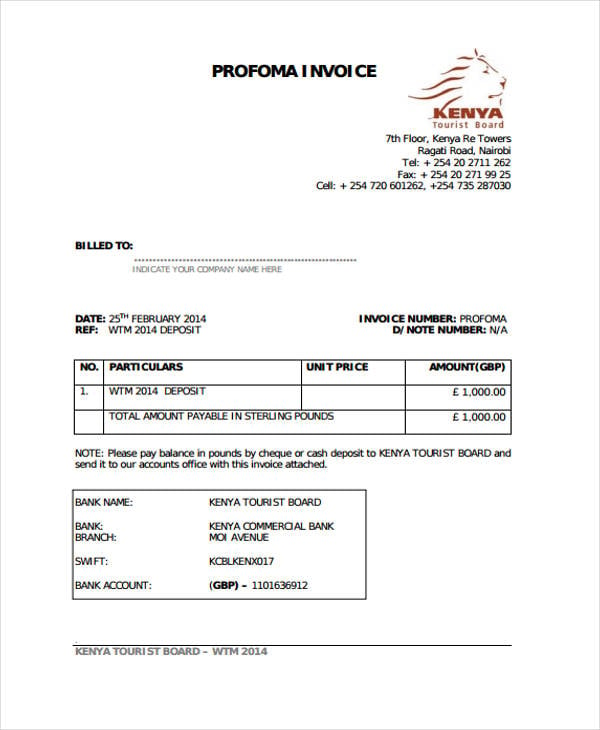

ktf.co.ke

File Format

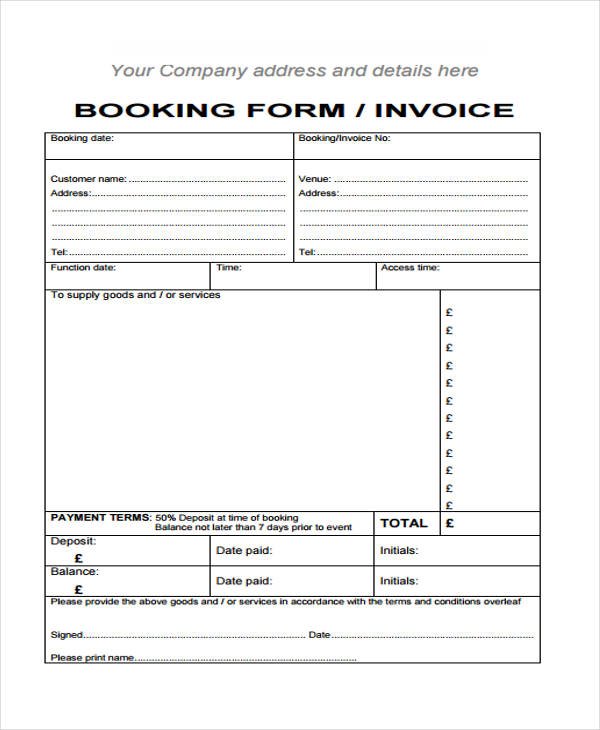

nabas.co.uk

File Format

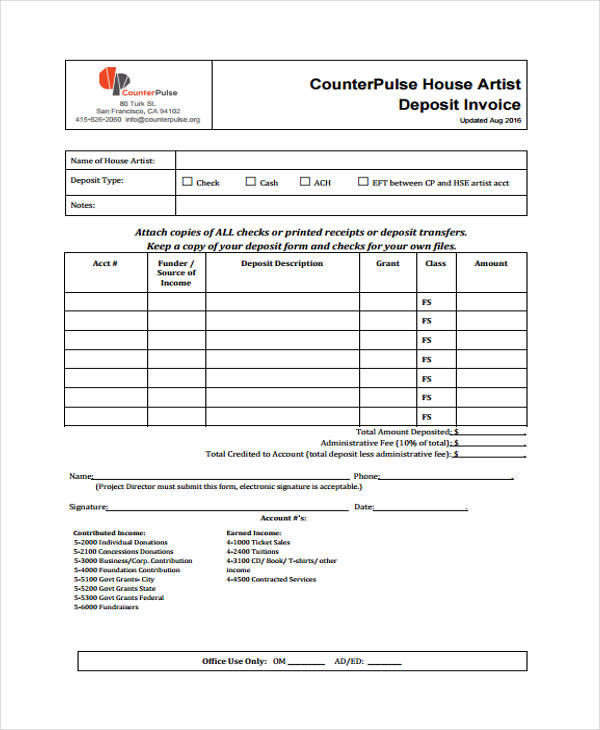

counterpulse.org

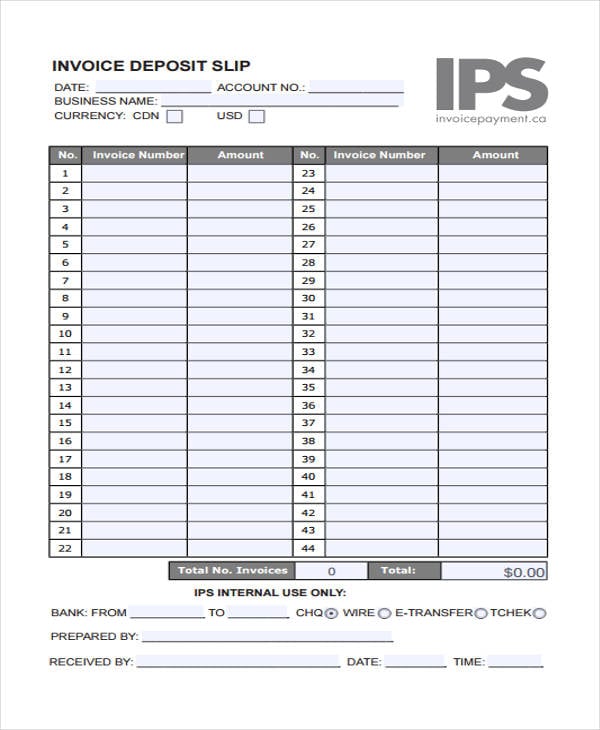

File FormatAdvance payment deposits have a tendency of getting mixed up with other deposits if they are not well-monitored. In instances where a lot of deposit transactions happen in a day, it is only proper for one to know how to invoice for an advance payment deposit.

One cannot do away with advanced payment deposits but one can always ensure advanced payment deposits are monitored in invoice format templates properly.